Why not try XM

XM Broker Review

Why not try XM

XM Broker Review

| Feature | 101investing |

| Minimum deposit: | $100 USD |

| Withdrawal fee amount: | |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | |

| Spread from: | |

| Number of instruments: | |

| Year founded: | |

| Time to open account: | |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | |

| Products offered: |

If you’re going to try and break into a very competitive industry then you’d better have something good to offer, fortunately for 101investing, this is certainly the case.

The firm which launched in 2020 brings a new approach to investing. It has fine-tuned trading processes and offers clients a particularly user-friendly experience. Its fresh and agile approach to trading makes for a positive user experience but is also backed up behind the scenes by high-grade infrastructure and customer protection.

The firm is an off-shoot of FXBFI which has taken the decision to provide a stand-alone platform for newer users. Head-quartered in Cyprus, at 13 & 15 Grigori Afxentiou str. IDE Ioannou Court, 4003 Limassol. They are regulated by CySEC, with the license number 315/16. The Broker’s LTD registration number is 351508.

One of the benefits of the site being so uncluttered is that it’s very easy to get an idea of costing. The firm has laid out the tariffs charged clients in much-welcomed clear and transparent way. Any firm with a willingness to be so open about its spreads usually knows its well positioned compared to the market and 101investing are just that. Spreads on major indices can be as low as 1.0 on the FTSE100. For EURUSD spreads come in as low as 0.7 of a pip.

Leverage depends on account type with the majority of accounts running in line with EU guidelines but Pro accounts offer leverage as high as 1:500.

Cross-referencing to comments made by members of the trading community picked up reports of inactivity fees at 101investing being very high. Dormant customers still ‘cost’ the firms as they still have to be accounted for in regulatory reports. The efforts of all brokers to discourage inactive accounts is understandable but punitive inactivity fees would be an issue for some. We couldn’t find any details relating to these charges on 101’s own site.

How are you finding our 101investing review? Is it useful? We would love your feedback and any comments you may have about your experience with 101investing.

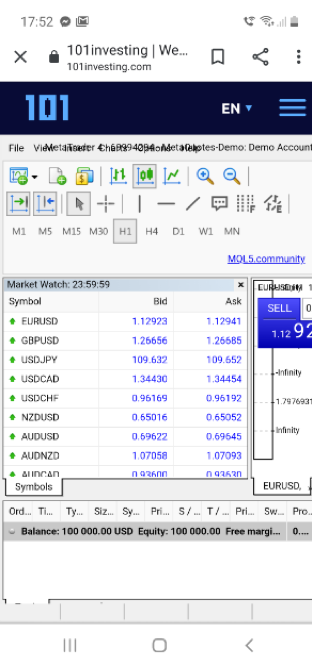

Trading at 101investing is carried out through the MetaTrader suite of platforms. If you’re going to choose one platform to trade with then MetaTrader4 (MT4) would be the choice of many. It is after all, the world’s most popular retail trading platform for very good reasons.

MT4 set the standard that other platforms follow. Few of the challengers can match it in terms of charting functionality which has an almost surgical accuracy. The trading interface is robust and reliable and also comes with the option of ‘one-click trading’.

Where MT4 stands out though is in terms of the indicators it offers. Charting tools, channels, the Gann and Fibonacci metrics and shapes, arrows and much more provide traders with a dashboard which offers support from analysis through to execution. Analytical objects can be applied to both charts and indicator windows and whilst the platform comes with 31 indicators as standard the number of third-party indicators available runs into the hundreds.

The platform comes in the traditional downloadable desktop format or as a Web Trader version. The latter still has more than enough functionality to allow traders to interrogate data and trade with ease and can be formatted to operate in one of 18 languages.

The platform has a well-earned reputation for being easy to trade proprietary models on. Beginner grade or super-advanced algorithmic models can be bolted onto MT4 meaning traders can take a more hands-off approach to finding trading opportunities in the markets.

101investing offer all the major markets and specialise in those which might appeal to beginners. There are more than 250 markets to choose from including major, minor and exotic forex pairs, as well as stocks, indices, commodities, metals and crypto.

The range of asset groups covered is adequate if not ground-breaking but that fits well with the firms approach to streamlining the trading experience.

Being a new entrant into an industry brings many challenges. On the other hand, there is the possibility to right from the start offer clients the latest technological advances.

The trading experience at 101investing really takes advantage of the cross-platform approach with account holders able to use the service on desktop, tablet and mobile devices. The mobile versions being available in iOS and Android format and free to download.

|

|

|

|---|

The 101investing mobile experience includes interactive quote charts, a full set of trading orders and the most popular analytical tools which brings it very close to the desktop version. It is also possible to monitor your account status, access trade history reports and set trade execution to ‘one-click’. There are also chat and push notification functions which are specialist add-ons designed specifically with mobile trading in mind.

How are you finding our 101investing review? Is it useful? We would love your feedback and any comments you may have about your experience with 101investing.

The research on offer is largely tailored to the needs of beginners. There is a comprehensive selection of ‘how to’ trade which will be welcomed by those trading for the first time.

There is also a range of materials designed to take traders to the next stage. This comes in a variety of formats including ebooks. The videos on trading strategies are straight to the point and likely to help traders improve their performance.

Day-to-day features such as the Economic Calendar are also on hand meaning clients can go into the markets fully prepared.

Customers can access 24/5 support via, phone, Live Chat and email.

We really like the click-to-call option where tapping the telephone icon on a trading screen offers a prompt for users to make the call via their phone. By removing the need to dial in numbers into their phone clients can contact support faster and easier but the lack of a free-phone number is worth noting.

The Live Chat provides faster response times than email but during our testing we found instances of it not being operational during week-day evenings. When they were on-line the Live Chat staff were attentive and professional.

One of our testers experienced a system glitch when their log-in was not recognised and after establishing the problem the Live Chat team rectified the issue in under ten minutes. The turn-around time of an issue such as this was in-line with or even better than the market norm. We were however alarmed that the issue occurred in the first place, and would not have wanted to have experienced it with large positions running in the market.

The email service is very user friendly. There is an option to contact support@101investing.com directly from personal email accounts. The simple functionality and crisp aesthetic of the on-platform email messaging service is also backed up by a ‘tick a box’ option to copy in personal email accounts into the conversation. Points go to 101investing for recognising that clients who want to use email are going to base the process off their personal accounts.

How are you finding our 101investing review? Is it useful? We would love your feedback and any comments you may have about your experience with 101investing.

With over 4,000 brokers active globally, it’s good to share your experience with others. Spread the word on good or bad brokers. Disclaimer: Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. If you are unhappy with any comments, please email complaints @ wecomparebrokers.com

Important: You (the person writing the comment) are responsible for any comments you post and use this site in agreement with our Terms.