| Feature | CAPEX |

| Minimum deposit: | €100 |

| Withdrawal fee amount: | |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | |

| Spread from: | |

| Number of instruments: | |

| Year founded: | |

| Time to open account: | |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | |

| Products offered: |

Introduction

Capex (previously CFD Global) is a relatively new broker which has already earned a reputation as one of the fastest-growing providers in the CFD trading industry (Fastest Growing Provider of 2018 award). It was also nominated for the Most Transparent Broker and the Best Dealing Room (both in 2018 as well).

The broker is CySEC regulated and promotes the highest safety standards to ensure its clients’ funds are secure through the segregated accounts option.

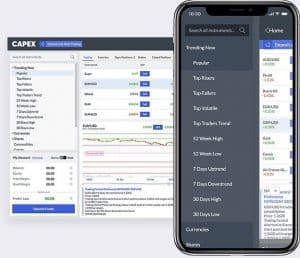

There are two platforms featured on Capex: MT5 and WebTrader. Highly intuitive, reliable and customisable to fit every trader’s needs, MT5 and WebTrader (available in desktop & mobile formats) take the user experience concept to a whole new level.

Capex offers a wide array of instruments and markets to trade. In total, clients have access to 2100 CFD instruments with attractive spreads on popular assets such as Forex, Indices, Shares, Cryptocurrencies, Commodities, ETFs and Bonds.

In addition, investors who want to become professional clients have this option available too. The pre-requisites to qualify for such status are listed in the image below.

Above all, the company states that its core mission focuses on providing investors with the expertise and resources necessary to create the optimal trading environment.

Commissions & Fees

This is an important aspect for any broker review, as obscure charges and costs can affect the overall trading experience.

Investors can breathe easy, as Capex doesn’t request any hidden commissions or fees. Therefore, they can trade as much as they desire, without having to pay anything extra. Additionally, the commission for deposits and withdrawals is 0.

Still, as for all the brokers in the market, Capex charges their clients with the conversion and the inactivity fee.

Conversion fee

Capex applies conversion fees to all transactions when the currency of traders’ accounts is different from the currency of their traded instruments. The conversion fee only applies to WebTrader users and is 0.5%.

Inactivity fee

Capex charges every inactive account with a $10 fee relating to maintenance, administration and compliance management. This fee only applies to customer accounts which are inactive for three months (90 days) or more, or if the customers fail to provide an Order.

Platforms & Tools

Capex enables investors to choose between the popular MetaTrader 5 platform and WebTrader, their proprietary web-based trading platform.

MetaTrader 5 offers a very comfortable and multi-functional trading experience. The platform is equipped with popular & reliable tools suited for more experienced investors:

WebTrader is the perfect choice for new investors, due to its extensive third-party market analysis and insight features, including:

Moreover, WebTrader grants access to other useful options and tools, such as:

Mobile Trading

Capex provides mobile solutions for iPhone and Android devices on both MetaTrader 5 and WebTrader platforms. The mobile apps are free of charge and anyone can download them from the Google Play Store and Apple App Store.

What’s remarkable is that the platforms don’t lose their functionality when accessed from mobile or other smaller-screen devices such as tablets.

Business24-7.ae:

“With the variety of products, tools, and instruments on offer, CAPEX provides a well-rounded package and stellar platform for traders at all levels of the market.”

FxExplained.co.uk:

“The broker makes its money through fixed and variable spreads. These spreads cover quite an impressive range, depending on the asset one trades.”

CompareBroker.info:

“All the features you can find with it prove that this broker is a transparent and regulated brand which is making all efforts to develop strong relationships with both newcomers and experienced investors.”

Research

Capex offers a wide range of financial instruments and markets for traders to choose from. They all embrace the form of CFD trading, coming with multiple advantages and benefits. As we mentioned at the beginning of our review, more than 2,100 CFD instruments on popular asset classes are included in the broker’s portfolio.

The Forex section on Capex hosts more than 55 currency pairs. The maximum leverage allowed is 300:1 (only Pro clients can benefit from it). For more information about trading conditions, the broker has a detailed list on its site. Clients should note that there are no commission charges whatsoever.

In the commodities section, there are 19 types available for trading, including the traditional oil, silver, and gold markets. The margin requirements are very reasonable, and the maximum leverage is 1:20.

Over 26 global indices (including DAX 30, FTSE 100 or VIXX) are listed in the indices section on Capex, with most of the global economy being covered. 200:1 is the maximum leverage.

The stocks category is the broadest of all asset categories. Clients can pick their preferred shares from 20 markets (and more than 2,000 tradeable stocks, including Facebook, Apple, Microsoft, Intel etc). Maximum leverage is 10:1.

When it comes to cryptocurrencies, Capex offers CFDs trading on the most popular digital coins, such as Bitcoin, Bitcoin Cash, Ethereum, Dash, Litecoin or Ripple. Their spreads are as low as 0.01 and the maximum leverage allowed is 1:2.

CFDs trading on ETFs is another section in the asset category on Capex. Traders have access to 30 Premium ETFs instruments with tight spreads from $0.03 and max leverage 1:5.

Finally, those who fancy trading CFDs on bonds will like the attractive EU, U.S and Japan Bonds available on Capex.

Customer Service

Although it was founded in 2016, Capex has managed to make an impression in the CFD industry:

The Capex website hosts eight different languages to accommodate a broad client base – Arabic, Czech, Polish, Bulgarian, German, English, Spanish, and Italian.

Their customer care team consists of Spanish, German, Italian and Arabic speakers that ensure all clients’ needs are met. They can be contacted via email, live chat, call back, fax and phone.

During our tests, the results were more than satisfactory: the average response time was fast, and the team proved savvy enough to solve any issue we put to them. Another great addition is that account managers contact the client as soon as he/she opens an account.

What others say

Generally, the reviews we found for Capex were favourable. For instance, forexfraud.com said that “CAPEX is blending traditional trading features with contemporary settings to offer traders the chance to express their own ideas through the latest trading software.”

We cannot agree more with this. Through their versatile trading platforms and industry-leading market analysis tools, Capex encourages all types of traders to start investing with them.

TopRatedForexBrokers also makes a valid point about Capex:

“Capex has provided a fairly in-depth array of training videos for its traders to refer to. At the same time, they are kept updated with all the developments in the market through the daily news feeds.”

The educational content that traders can find on Capex consists of daily and weekly market news, an eBook, 14 beginner-level training videos, and 24 advanced training videos

With over 4,000 brokers active globally, it’s good to share your experience with others. Spread the word on good or bad brokers. Disclaimer: Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. If you are unhappy with any comments, please email complaints @ wecomparebrokers.com

Important: You (the person writing the comment) are responsible for any comments you post and use this site in agreement with our Terms.