| Feature | FXPrimus |

| Minimum deposit: | $100 USD |

| Withdrawal fee amount: | |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | |

| Spread from: | |

| Number of instruments: | |

| Year founded: | |

| Time to open account: | |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | |

| Products offered: |

FXPrimus is a well-regarded global broker with a focus on providing traders with institutional grade trade execution. Founded in 2009 it now has a client base of hundreds of thousands of traders. It has achieved this growth by taking advantage of being relatively new to the space and designing an operational framework which focuses on the essence of the trading experience. Technology, education and safety are the three touchstones of the service.

The trading experience is based off the tried and tested MetaTrader MT4 platform and in the area of technological trading frameworks FXPrimus has a lot to shout about. The firm has set up its trading structures to allow traders to get as close to the markets as possible. This includes in the physical sense as well with data centre locations being well thought out and API and VPS trading services being offered to clients with relatively small capital balances. This leads to a trading experience which is fast and robust, with excellent flow and using spreads as tight at 0.1 pips.

Trade execution fees start at levels as low as 0.1 pips and the firm offers a live dashboard of spreads. Tools such as this are a sure sign that a broker is comfortable with its pricing and FXPrimus is certainly placed at the more competitive end of the sector.

The fondness for live reporting extends to FXPrimus offering a table which shows real-time spreads on both ‘ECN premier’ and ‘variable spreads’.

What is refreshing is that FXPrimus extend the same transparency to financing costs. The Swap rates section is subject to a daily update rather than live pricing but even so is a step up on a lot of other brokers in the peer group. With the difference between profit and loss sometimes being down to marginal differences the provision of an accurate and easy to use matrix is a real benefit.

FXPrimus provide all their clients with access to the world’s most popular retail trading platform, the MetaTrader MT4 platform.

MT4’s popularity stems from it offering traders access to top quality analysis and execution tools which are a combination of power and agility. The dashboard has a clinical feel to it. Execution can for example be adjusted to 1 click trading. Position reporting also shares the same functionality with all the information close to hand, but not in the way.

The analytical tools on MT4 are much loved by members of the trading community. The powerful software tools which help identify market trends and trading opportunities can be easily incorporated into analysis and strategy development. They are also easily removed which is particularly useful as there are so many of them. MT4 provide a number of indicators as part of the standard package. There are then hundreds more which have been developed by others and are available free of charge. Those who still haven’t found the tool they need might want to then consider one of the off the shelf indicators which can be purchased.

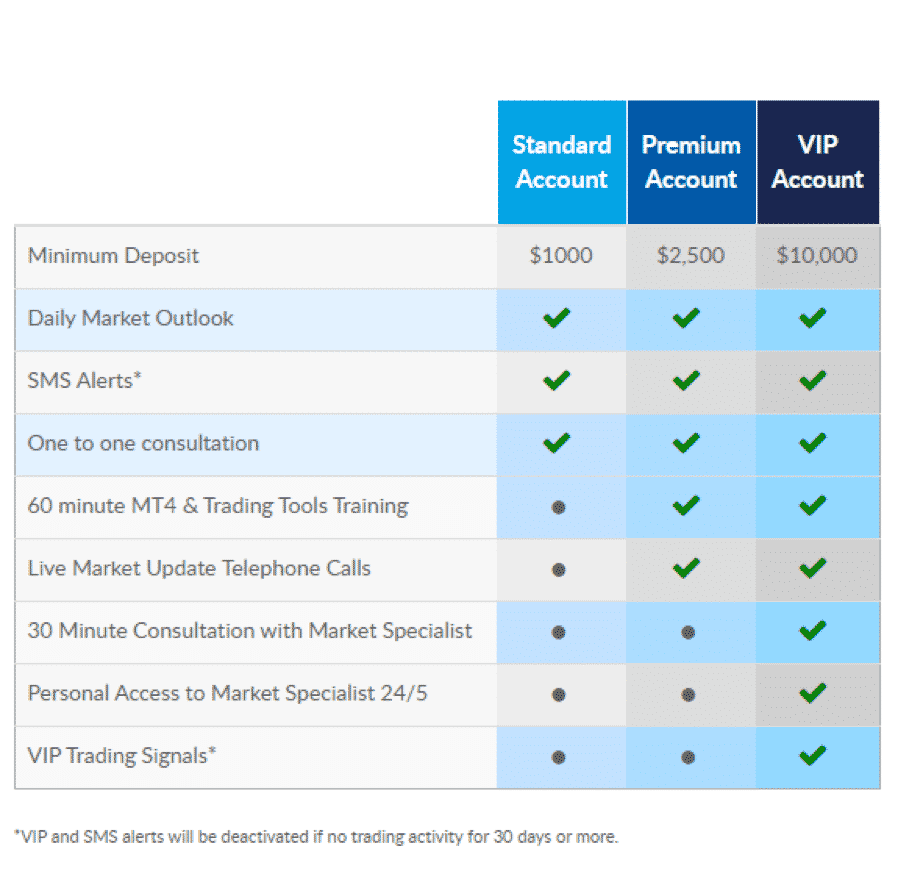

FX Primus account types vary The MT4 platform’s sweet sport is trading of forex. FXPrimus accordingly offer a range of major, minor, crosses and exotic pairs. A nice to have feature is the Trade Forex Now section which details the trading terms of each pair.

The MT4 platform’s sweet sport is trading of forex. FXPrimus accordingly offer a range of major, minor, crosses and exotic pairs. A nice to have feature is the Trade Forex Now section which details the trading terms of each pair.

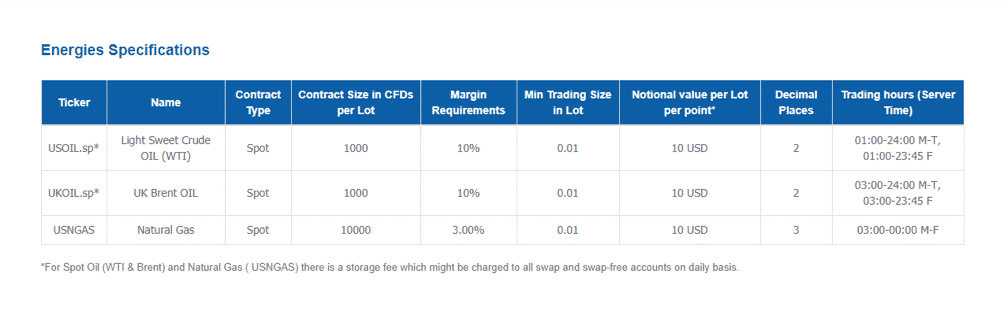

There are also 3 energy instruments to trade, 8 global equity indices and 3 metals. The rest of the markets on offer are made up of single stock names.

The FXPRIMUS MetaTrader 4 platform supports multiple base currencies including USD, EUR, GBP, SGD and AUD. The dashboard can be set to over 30 different languages and there is also the MetaTrader community on hand where traders and analysts share ideas and information on markets and strategies.

FXPrimus demonstrate a genuine desire to use research and learning tools to develop the trading experience of its clients. The range and quality of resources backs up their stated aim of making trader education a cornerstone of their service.

The offering covers the whole range of trader profiles. There are ‘How To Trade’ style videos, webinars, expos and research notes which cater to getting novice traders up and running. Significantly the firm also offers resources for intermediate and advanced traders as well. Not all brokers cover the more experienced members of the trading community so FXPrimus deserve recognition for doing so.

Research notes, Daily Market News reports and the Weekly Market Review feature are all designed to empower traders.

Research notes, Daily Market News reports and the Weekly Market Review feature are all designed to empower traders.

Those which are already up and running might consider testing the trading signals which are provided for no charge. The firm also offers an ‘Expert Guest’ feature where an experienced trader shares their thoughts on the markets.

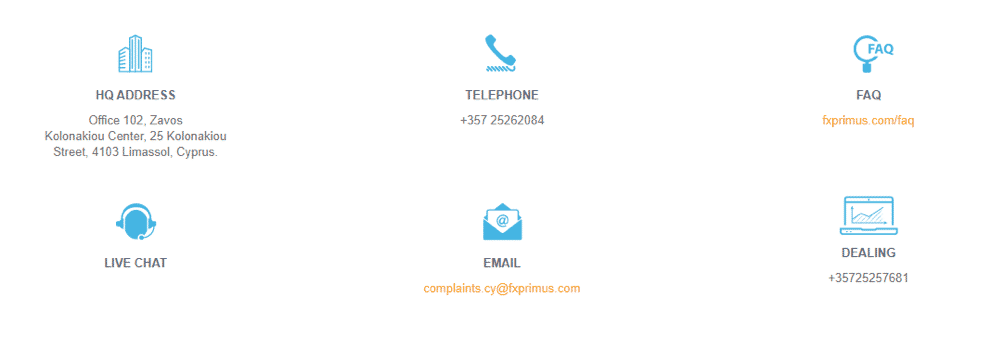

FXPrimus customer support is offered in a variety of formats. Live Chat, telephone and email are all available. The Live Chat response times were very good. In our tests we were directed to a genuine operator within 15 seconds. During instances when our query was in a queue, our testers were still up and running within that time. The staff were knowledgeable and professional and 92% of questions were resolved on the first occasion.

One glitch which relates to screen functionality rather than the support team was that the Live Chat window did ‘disappear’ and prove hard to find. In some instances, our testing team had to restart the Chat. Whilst this didn’t derail the process it was frustrating.

Support is offered on a 24/5 basis and the support team advised they have access to a translator tool which means their expertise can be applied across the globe. This is obviously useful considering the claims that they have clients in over 200 countries.

Support is offered on a 24/5 basis and the support team advised they have access to a translator tool which means their expertise can be applied across the globe. This is obviously useful considering the claims that they have clients in over 200 countries.

With over 4,000 brokers active globally, it’s good to share your experience with others. Spread the word on good or bad brokers. Disclaimer: Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. If you are unhappy with any comments, please email complaints @ wecomparebrokers.com

Important: You (the person writing the comment) are responsible for any comments you post and use this site in agreement with our Terms.