eToro crypto has long been known for leveraged trading and it grew up in the boom of the bitcoin explosion where it attracted thousands of new traders who wanted to try their hand at leveraged bitcoin trading. At the time, a trader could use a leverage (or CFD or Spread Betting as its known) of up to 300:1, which meant that for every £1 of trade placed, eToro would place a trade for up to 300 times that.

You can probably guess that this leads to a lot traders making or losing a lot of money very quickly. In August of 2018, ESMA (the EU version of the FCA) changed the rules to protect traders and reduced the maximum leverage down by tenfold on most equities (down to 30:1) and on cryptocurrencies, down to 2:1. This had a dramatic effect of reducing the number of people trading in the EU. However, slowly but surely traders have got used to this lower leverage and there is a return to new traders signing up. But with such a small leverage, it makes the downside of a CFD trade hardly worth the effort.

When you trade a cfds (contracts for difference) you never actually own the underlying asset. The broker does. You are effectively borrowing money in the form of a trade from the broker. The downsides of CFD trading is that if you go long and hold the position overnight you are usually charged interest, while it’s only a very small % it soon adds up if you have to hold your trade for several weeks while you await it’s hoped-for return to profit.

The other issue is that if the trade is a short and the market moves the wrong way, theoretically there is no limit to your losses, except there is (as imposed by the broker on what your debt to equity ratio is) and you will get your trade closed, and thereby make a loss.

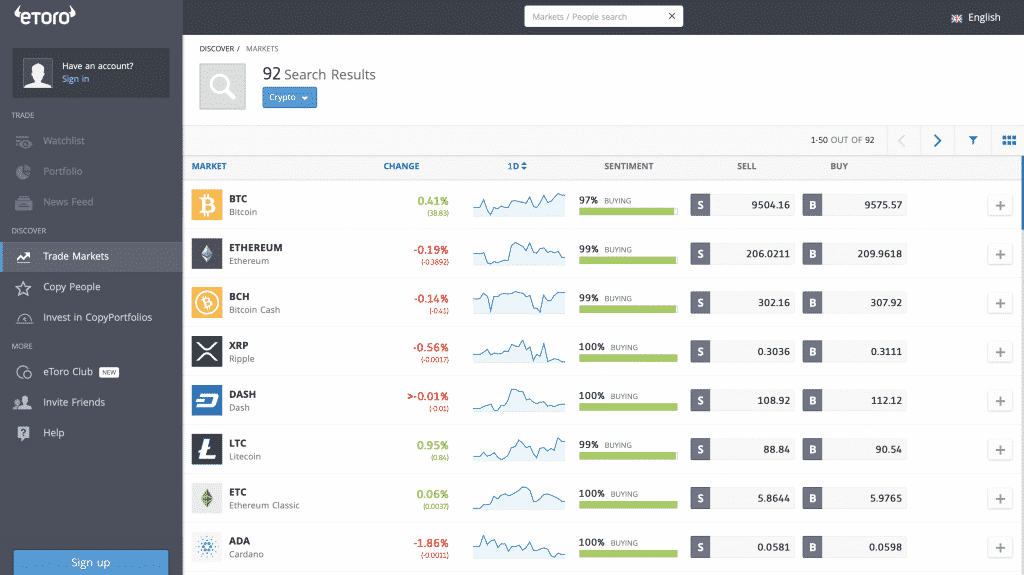

However, the good news with eToro crypto! Unlike many brokers, eToro now lets you buy some of the main crypto assets and alt coins on a 1:1 basis which means its treated like when you buy shares. There are no “dividends” with crypto assets but you can hold a long position as long as you like, you are not charged overnight interest fees and it could fall away to be worth zero but you will not get stopped out. You can also short too, this type of trade is treated similar to a CFD in that you can get stopped out.